Upbeat start to week – and month – likely for Aussie market

After a strong session for global markets on Friday, Australian shares will take a positive lead into the new week – and month.

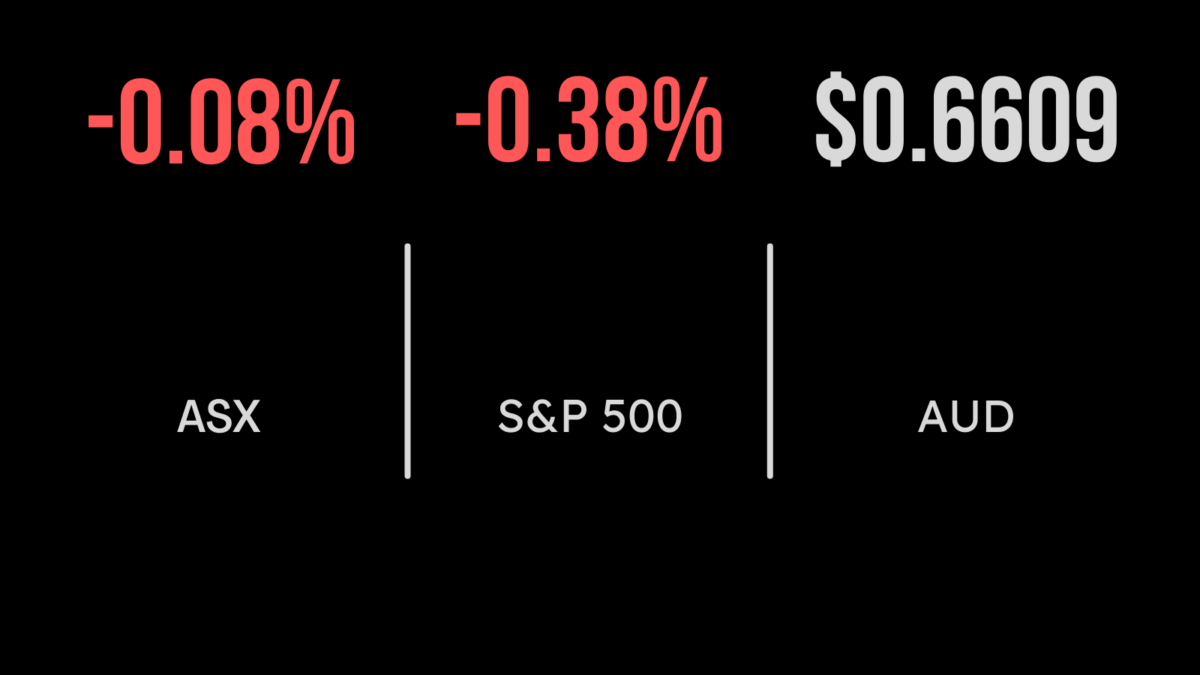

The Australian benchmark index, the S&P/ASX 200, added 16.5 points, or 0.2 per cent, on Friday, to 7,309.2, but eased 53 points, or 0.7 per cent over the week. ASX futures trading suggests a rise on Monday after the three major US indices all pushed higher in Friday trading, with the 30-stock Dow Jones Industrial Average gaining 272 points, or 0.8 per cent, to 34,098.16; the broader S&P 500 putting on 34.1 points, or 0.8 per cent, to 4,169.48; and the tech-heavy Nasdaq Composite Index rising 84.35 points, or 0.7 per cent, to 12,226.58.

For the month, the Dow gained 2.5 per cent, its best month since January, while the S&P 500 index gained 1.5 per cent, and the Nasdaq posted a marginal gain.

Earnings reports from several big technology companies, including Meta, helped the end-of-month mood.

Volatility in the stock market has not bubbled higher, despite the US banking jitters not receding: First Republic Bank has been exploring talks with multiple partners about strategic options, including, potentially, asset sales.

In the bond market, the US 10-year Treasury yield lost 1.9 basis points on Friday, to 3.433 per cent, while the more policy-sensitive 2-year yield was unchanged at 4.02 per cent.

In commodity markets, gold eased US$1.88 to US$1,987.79 an ounce over the weekend, while the benchmark Brent crude oil eased 45 cents, or 0.6 per cent, to US$79.88 a barrel and US West Texas Intermediate shed 43 cents, also 0.6 per cent, to US$76.35 a barrel.

The Australian dollar fell to 66.16 US cents from its previous close of 66.29.