Strong start to 2023 continues

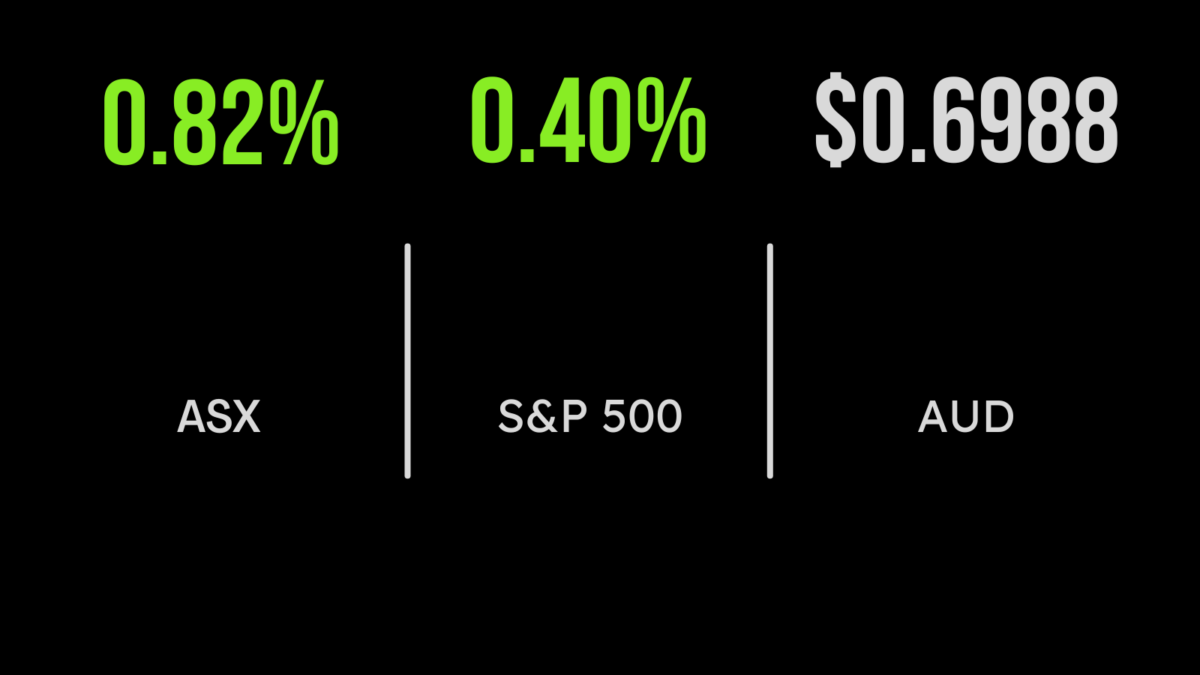

The Australian shares benchmark gained 60.1 points, or 0.8 per cent, on Monday to reach its highest level in nine months, at 7,388.2 points. The S&P/ASX 200 has had a good start to 2023, racking up a 6.4 per cent gain so far. The broader All Ordinaries index added 64.9 points, or 0.9 per cent, to 7,605, to be up 6.7 per cent year-to-date.

The local market shrugged off an iron ore price fall triggered by further measures taken by China to try to crack down on iron ore trading irregularities that it sees are playing into a higher price. In response, Fortescue Metals ended 47 cents, or 2.1 per cent lower, at $22.33, but BHP managed a rise of 0.1 per cent, to $49.69. Rio Tinto eased 0.1 per cent, to $122.17.

Emerging lithium-boron producer Ioneer provided the highlight of the day, jumping almost 21 per cent, to 55 cents, after the US Department of Energy finalised terms for a $US700 million ($1 billion) loan to develop the company’s Rhyolite Ridge lithium project in Nevada.

Elsewhere in lithium, IGO gained 9 cents to $14.75, Pilbara Minerals rose 5 cents to $4.04, and Allkem gained 1 c to $12.48. Mineral Resources fell 8 cents to $88.41.

Mixed day for retailers

Retailer Super Retail Group surged 88 cents, or 7.7 per cent, to $12.34 after saying that first-half revenue would rise 15 per cent, to $1.96 billion. The owner of Macpac, Rebel Sports and Supercheap Auto said same-store sales were up 11 per cent in the first half. The news seemed to inspire the retail sector, with Myer gaining 6 cents, or 8.6 per cent, to a five-year high of 76 cents, JB Hi-Fi adding 3.4 per cent to $47.10 and Adairs rising 10 cents, or 3.6 per cent, to $2.89.

But fellow retailer Baby Bunting hit the skids, dropping more than 11 per cent to $2.68 after reporting weaker-than-expected sales in the first half. First-half sales rose 6.6 per cent to $254.9 million from a year ago.

Among the big banks, Westpac was up 17 cents, or 0.7 per cent, to $23.93; ANZ was up 1.6 per cent to $24.89; NAB added 1.1 per cent to $31.65, and Commonwealth Bank gained 85 cents, or 0.8 per cent, to $107.35.

Green day on Wall Street

On the US markets, the broad S&P 500 index advanced 15.9 points, or 0.4 per cent, to 3,999.09 overnight, while the 30-stock Dow Jones Industrial Average added 112.6 points, or 0.3 per cent, to 34,302.6 and the tech-heavy Nasdaq Composite Index was up 78 points, or 0.7 per cent, to 11,079.2.

Gold was down US$1.61 to US$1,915.63 an ounce, while in energy, the benchmark Brent Crude oil grade eased US$1.25, or 1.5 per cent, to US$84.03 and West Texas Intermediate lost US$1.01, or 1.3 per cent, to US$78.85. The Australian dollar is buying 69.53 US cents, down from 69.9 cents late yesterday.