Retail rally points to rising rates

Australian retail sales rebounded in January as household spending defied inflation and higher borrowing costs, strengthening the case for the Reserve Bank to keep raising interest rates, and run a “higher for longer” rates scenario, taking its cue from its central bank peers in the US and Europe. Retail sales rose 1.9 per cent in January after an unexpected drop in December.

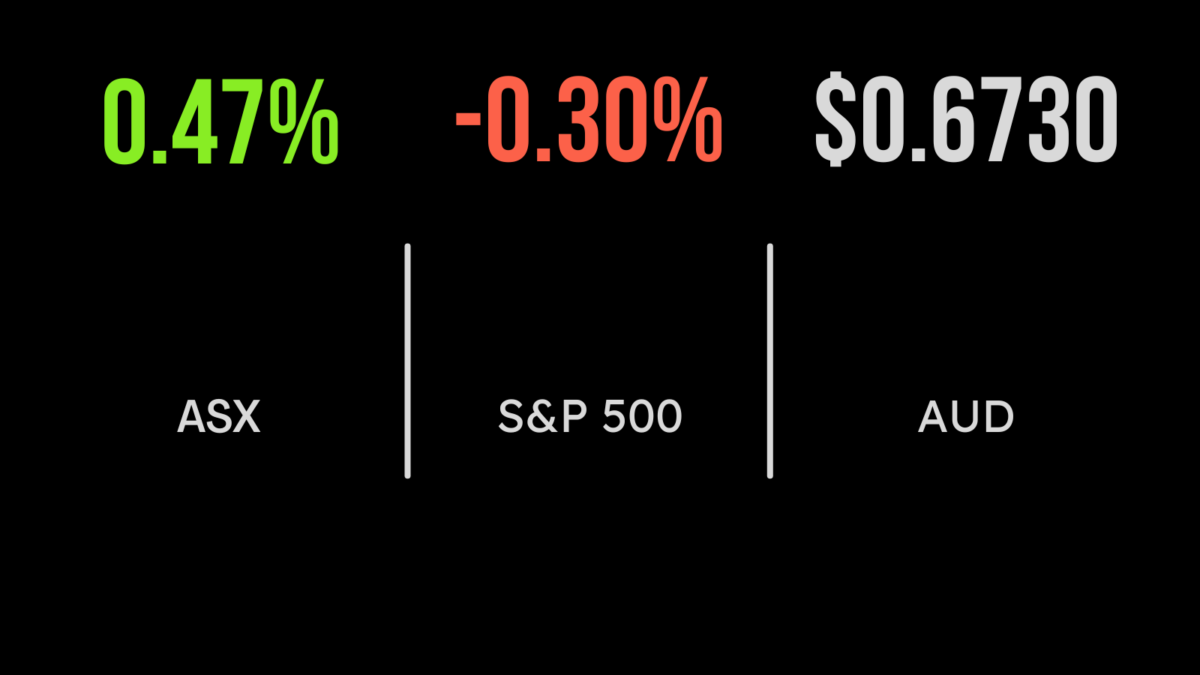

The S&P/ASX200 rose 33.6 points, or 0.5 per cent, to 7,258.4, but that represented a 2.9 per cent slide for February. The broader All Ordinaries finished Tuesday up 38.4 points, or 0.5 per cent, to 7,458, to show a 3.3 per cent decline in February.

Shares in Harvey Norman, the country’s largest homewares and electrical retailer, fell 31 cents, or 7.5 per cent, to $3.85 as the company said its interim net profit slipped 15 per cent, to $366 million. Revenue rose 1.4 per cent to $4.98 billion in the six months ended December 31. Harvey Norman cut its interim dividend from 20 cents a year ago to 7 cents.

Among the big banks, Westpac lost 20 cents, or 0.9 per cent, to $22.53; National Australia Bank eked-out a 1 cent gain to $30.00; ANZ was down 18 cents, or 0.7 per cent, to $24.65; and Commonwealth Bank fell 70 cents, or 0.7 per cent, to $100.69. Investment bank Macquarie Group advanced $1.07, or 0.6 per cent, to $189.52

Biotech leader CSL was down $1.49, or 0.5 per cent, to $296.30.

Resources ride to the rescue

The mining and energy sectors were both stronger on the day. Of the big miners, BHP added 65 cents, or 1.5 per cent, to $45.20; Rio Tinto gained $1.27, or 1.1 per cent, to $116.73; and Fortescue Metals advanced 59 cents, or 2.8 per cent, to $21.40.

In lithium, Allkem rose 19 cents, or 1.7 per cent, to $11.35, while fellow producer Pilbara Minerals eased 3 cents to $4.17. Mineral Resources, which mines iron ore as well as lithium, improved by $3.06, or 3.9 per cent, to $82.56, while IGO, which is a lithium and nickel producer, gained 22 cents, or 1.7 per cent, to $13.13. Among the project developers, Lake Resources jumped 4 cents, or 6.8 per cent, to 62 cents; Liontown Resources was up 4.5 cents, or 3.4 per cent, to $1.36; and Piedmont Lithium surged 6.5 cents, or 7.3 per cent, to 96 cents.

In the coal space, Whitehaven Coal was unchanged at $7.23; New Hope Corporation advanced 3 cents, or 0.6 per cent, to $5.43; Coronado Global Resources added 2.5 cents, or 1.3 per cent, to $1.90, but Yancoal slipped 31 cents, or 5 per cent, to $5.86; and Stanmore Resources retreated 3 cents, or 0.8 per cent, to $3.53.

In oil and gas, Woodside Energy was up 78 cents, or 2.2 per cent, to $35.91;

Santos gained 11 cents, or 1.6 per cent, to $7.00; and Brazilian-based producer Karoon Energy added 6 cents, or 2.6 per cent, to $2.34.

Bruising February ends for US markets

In the US, the major indices all fell, to complete a tough month for the stock market. The broad S&P 500 index lost 12.1 points, or 0.3 per cent, to 3,970.15, making a 2.6 per cent slide in February. The blue-chip Dow Jones Industrial Average retreated 232.39 points, or 0.7 per cent, to 32,656.70, to be down 4.2 per cent for the month. The tech-heavy Nasdaq Composite Index gave up 11.4 points, or 0.1 per cent, to 11,455.54, for a 1.1 per cent February decline.

In the bond market, the benchmark 10-year Treasury bond yield eased one basis point to 3.912 per cent, after touching a four-month high at 3.983 per cent. The more policy-sensitive 2-year yield advanced 2.7 basis points to 4.818 per cent.

On the commodities front, gold rose US$9.90, or 0.5 per cent, to US$1,827.16 an ounce, while the global benchmark Brent crude oil grade surged US$1.44, or 1.8 per cent, to US$83.89 a barrel and the main US grade, West Texas Intermediate, advanced US$1.10, or 1.4 per cent, to US$76.78 a barrel.

The Australian dollar is buying 67.28 US cents this morning, a slight gain on the 67.24 US cents at the local close on Tuesday.