A difficult path ahead to avoid a hard landing

Following the re-opening of global markets post-Covid, there was a sudden change in macro-economic conditions caused by massive stimulus spending and supply constraints. Central bankers were caught asleep at the wheel, while inflation was surging in the background.

An initial assessment downplayed the severity and labelled this rise in inflation as ‘transitory’ and not something that was permanent. The RBA admitted inflation “has picked up significantly and by more than expected” and previous forecasts were wrong. This, set the stage for central banks to over-react when US inflation came in at 7.1 percent and begin an aggressive rate hiking campaign.

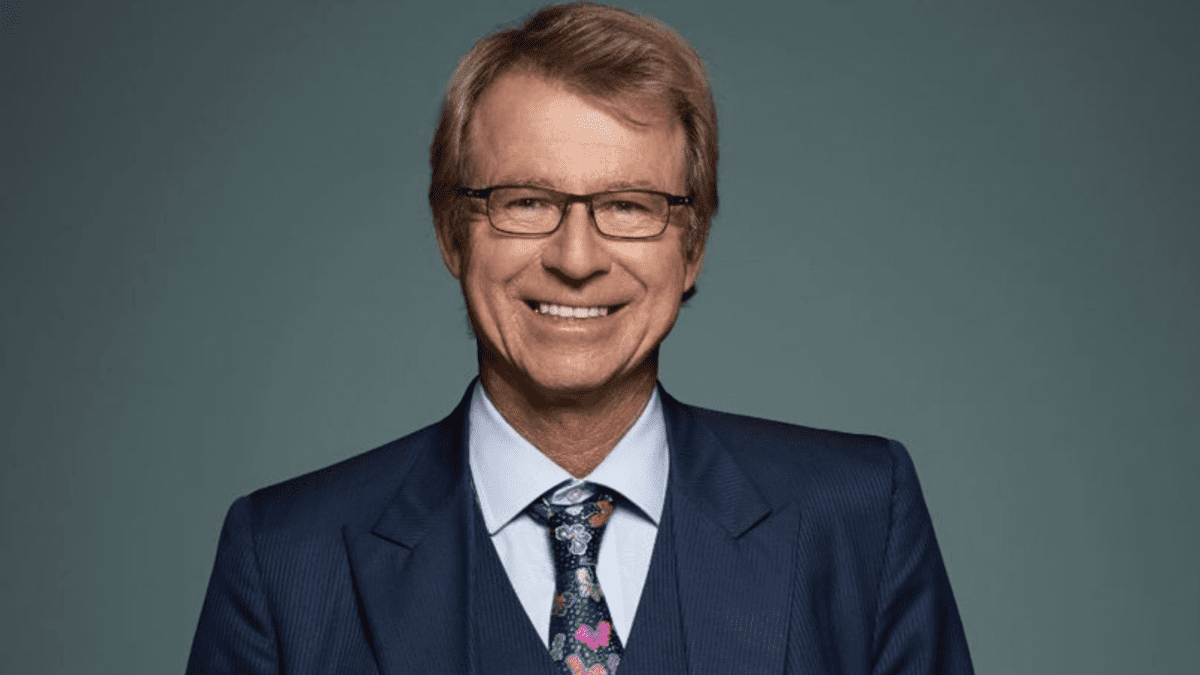

Peter Warnes, Head of Equities Research, Morningstar Australasia, says “central banks are now talking tough. After months behind the ball, belated heavy-handed action is raising fears of a recession next year. A growing body of opinion believes rates may need to be cut again in 2023 as economic growth slides.”

Warnes believes that the Federal Reserve is doing more damage by trying to bring inflation under control due to its harmful side effects in killing economic activity. The truth is that elevated inflation is going to be around for the next two years and negative real interest rates needs to be reversed.

With that in mind, Warnes says, “The Federal Reserve (the Fed) needs to stop protecting equities markets and encouraging risk-taking. Elevated inflation is a likely passenger for most of 2022 and negative real interest rates should be reversed as a priority.”

Equities have done extraordinarily well in a low-interest rate environment. Bond yields have benefited from the suppression of bond yields. Warnes says, “their normalisation will bring risk asset valuations into question. It will also affect capitalisation rates used in commercial real estate valuations.

“If the US Federal Reserve managed to push the cash rate to 3.0 percent and shrink its balance sheet by the planned US$1.3 trillion by September 2023, it will be in a historically weak position.”

In Australia, Warnes says to be prepared as the good times fade. Economic growth is likely to slow but much of this will be determined by the effectiveness of the central bank campaign to rein in inflation.

Warnes says, “If inflation manages to get to 7 percent, an official cash rate of at least 3.5 percent is required to stem the surge. History suggests it should be much higher to be effective. Mortgage rates well above 5% are likely and the narrow path to a soft landing will become more difficult to traverse.”

Energy and commodity prices will fall but not likely anytime soon. The war in Ukraine is still going, four months on, and so are high energy prices as well as soaring lithium prices.

Warnes highlights the fact that “energy prices were already strong in the ascendant prior to Russian actions due to re-opening of economies and resurgent demand as the effects of the pandemic eased.” Even if the war was over tomorrow, Western European countries will continue to avoid the gas trade with Russia. The gap will be filled from alternative sources of energy with an increasing uptake of renewables, which should take the sting out of energy prices.

| Company | Ticker | Price | FVE | P/FV | Relevant Energy Exposure |

| Woodside Energy | WDS | $ 31.30 | 40 | 0.78 | Oil & gas production |

| Santos Limited | STO | $ 7.40 | 10.2 | 0.73 | Oil & gas production |

| Beach Energy | BPT | $ 1.65 | 2.7 | 0.61 | Oil & gas production |

| Ampol Limited | ALD | $ 33.80 | 32 | 1.06 | Oil refining and fuel retail |

| Viva Energy | VEA | $ 2.80 | 2.65 | 1.06 | Oil refining and fuel retail |

| Worley Limited | WOR | $ 13.95 | 12 | 1.16 | Energy engineering and construction |

| Mineral Resources | MIN | $ 50.00 | 63 | 0.79 | Lithium production/gas exploration |

| Whitehaven | WHC | $ 4.70 | 5.2 | 0.9 | Thermal coal production |

| New Hope Corp | NHC | $ 3.35 | 4 | 0.84 | Thermal coal production |

| Monadelphous Group | MND | $ 10.35 | 13.04 | 0.79 | Oil & gas sector maintenance contracts |