Two winners from budget spending spree

A big-spending budget focused on improving regional Victoria, health, housing, education, and transport infrastructure but at the same time pushing debt to eye-watering levels during a recession were the main hallmarks of the Andrews Government’s state budget.

To sum it up, it is a Budget tilted towards rebuilding the state economy from the ground up. The Budget included some big-ticket items such as a halving of stamp duty for those buying new homes valued at less than $1m, which are expected to provide massive savings for homebuyers. The Victorian Government will build 12,000 homes over the next four years and will spend big on hospital and health. Other winners include schools, transport, clean energy, hospitals, home buyers, healthcare workers, the tourism sector, unemployment and businesses ravaged by COVID-19 and bushfires.

On the flip side, losers from this year’s budget will be the future generation left to foot the $155bn bill from the Government’s spending spree. Electric car owners, unsafe drivers and farmers who were hoping for significant investment in infrastructure were also left disappointed. For the purposes of this article we will look at two stocks that stand to benefit from this budget.

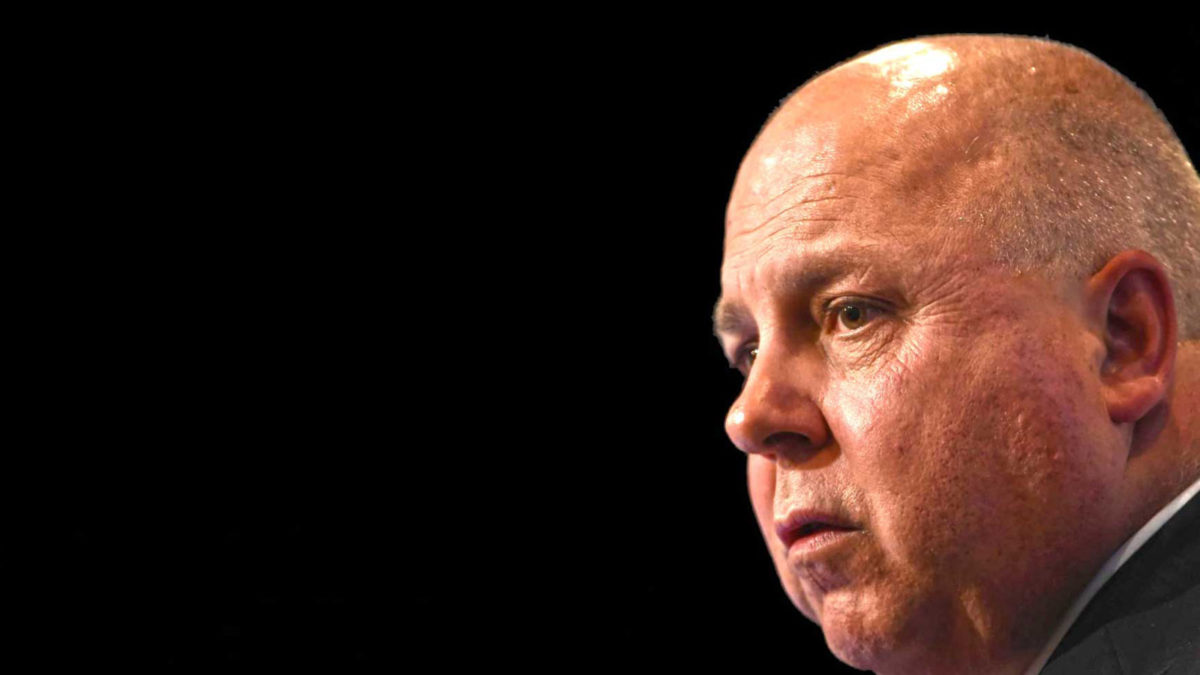

Bendigo and Adelaide Bank (ASX:BEN)

This year’s budget was heavily aimed at stimulating the Victorian property market with roughly $6 billion to be spent on housing initiatives. First home buyers and those looking to buy will be treated with a 50% discount on stamp duty on a home purchase which is below $1m.

According to the AFR “land tax on build-to-rent developments will be halved from 2022 through to 2040 and the new dwellings will be exempt from the Absentee Owner Surcharge, which the government hopes will increase housing supply by 5000 jobs.” The budget also included support for Regional Victorians through an upgrade in travel to and from Melbourne and spending on social and affordable housing. And finally, more people will be encouraged to travel to bushfire-affected tourist regions to help the sector rebuild and recover by building restaurants, pubs, hotels and small businesses in the area.

All of the above bodes well for Bendigo & Adelaide Bank. As more people and businesses move to Regional Victoria it brings more business to the bank as the main lender in Regional Victoria. Bendigo’s share price has already started recover and with the re-opening of Melbourne CBD but a strong property sector bodes well for banks in general.

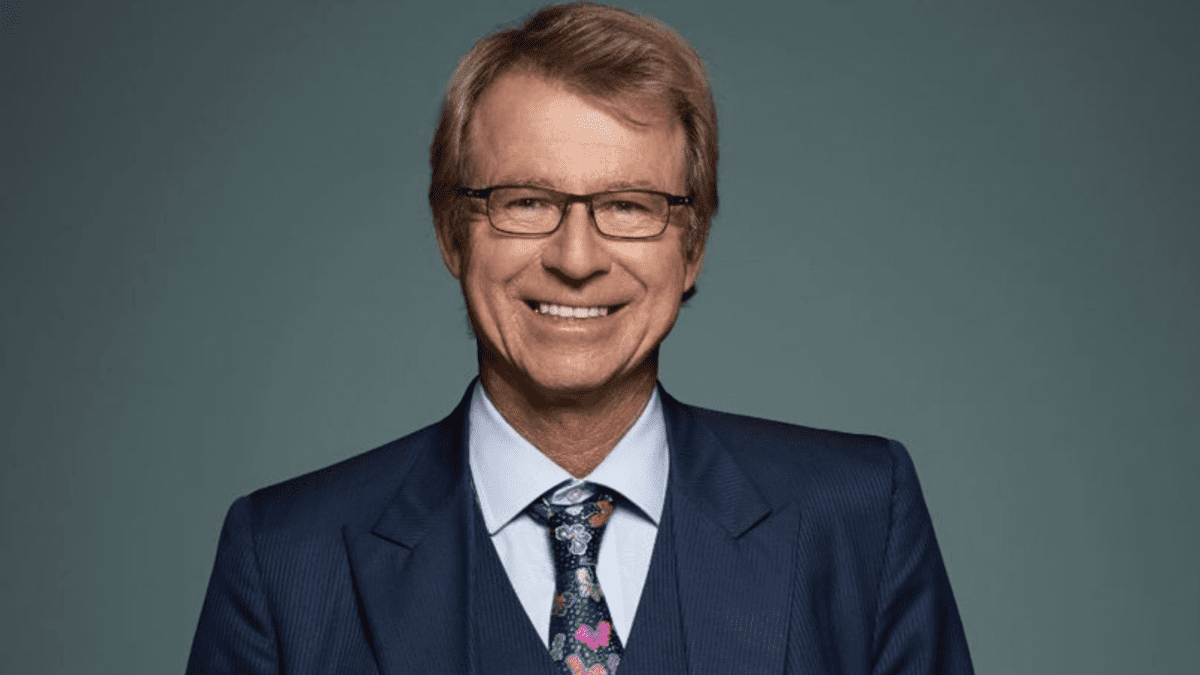

Webjet (ASX:WEB)

The Tourism Industry Council has welcomed the Budget after the Andrew’s Government announced significant spending to secure Melbourne’s position as the major events capital and a centre for the arts and culture. The Budget is spending $465 million on a tourism package that includes $200 vouchers for tourists to regional Victoria. All done to encourage more visitors to regional Victoria as part of the Victorian Tourism Recovery Package.

In addition to this, another $149 million will be spent on building new tourism infrastructure in regional towns. Webjet is the main online travel website that specialises in booking hotels in regional Victoria.

While the majority of the world is still battling COVID-19, domestic leisure markets will be the first to open up and see a massive increase in tourist activity. Webjet is better placed than rival Flight Centre Travel Group (ASX: FLT) or any other booking agent to capture this upside potential.