-

Sort By

-

Newest

-

Newest

-

Oldest

Robotics of the future will make life easier for humanity, creating more room for optimism than despair.

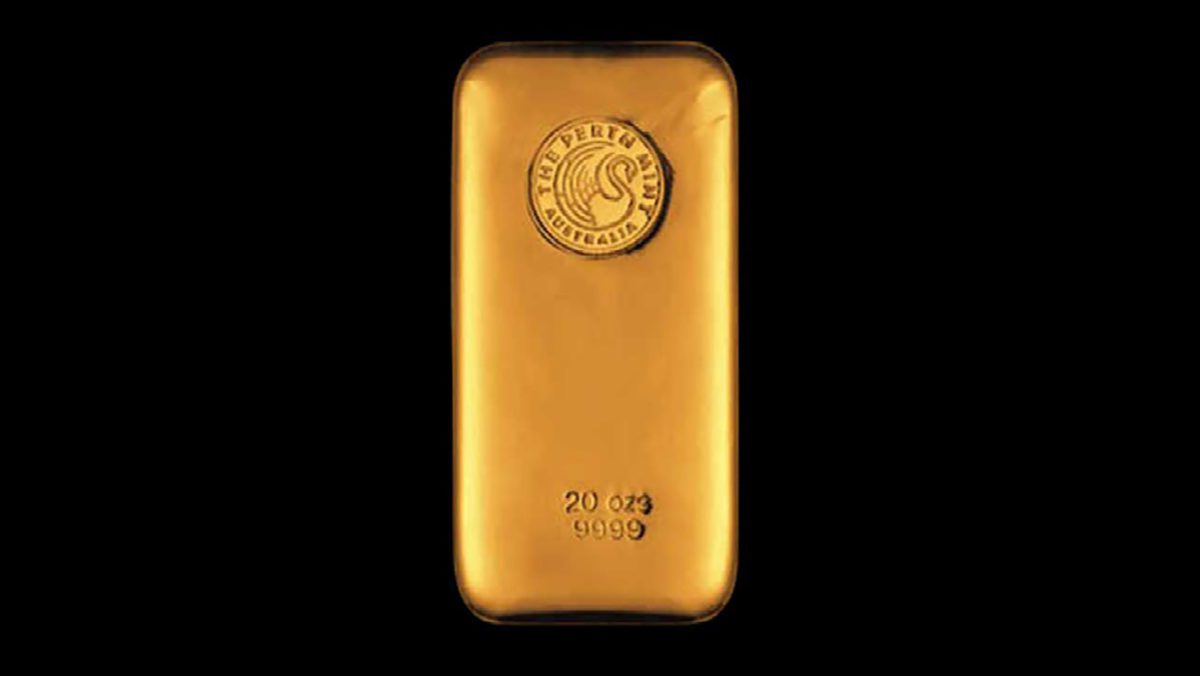

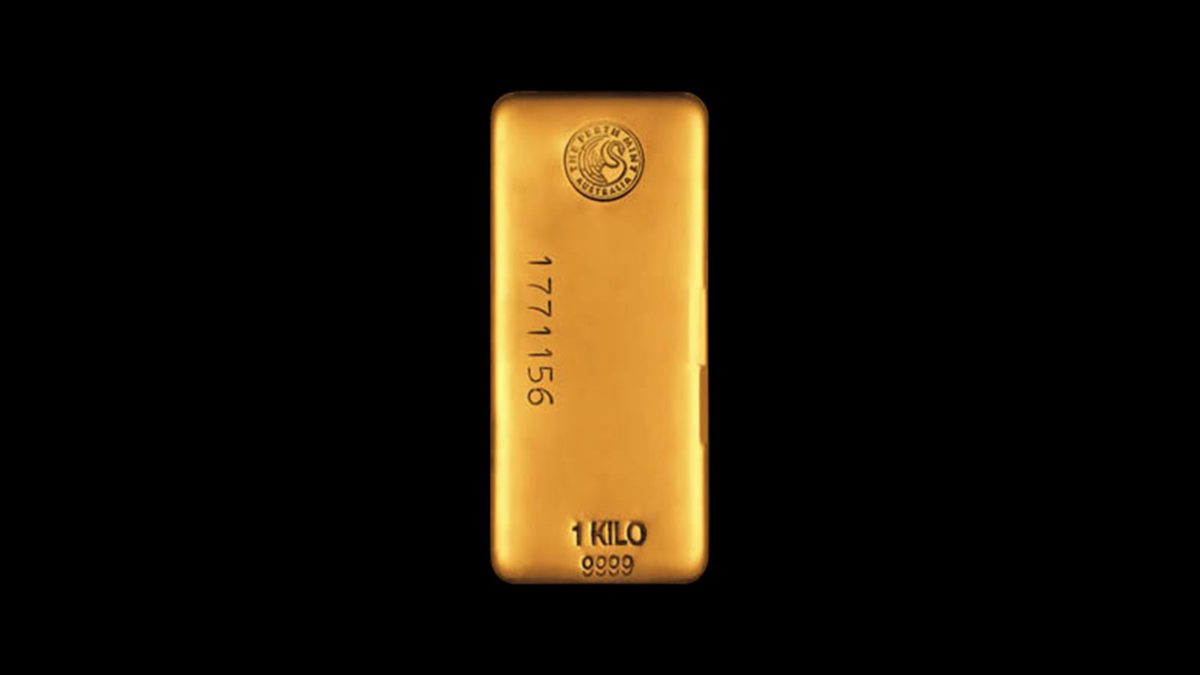

While gold has long been regarded as the “safe haven” asset during times of fear and peak volatility, the investment team at ETF Securities has highlighted a group of investment assets that share similar qualities to that of gold, allowing the same safe-haven status.

The exchange-traded fund (ETF) sector has been among the biggest winners of the pandemic, seeing significant inflows and more investors entering the market. Among the most popular strategies to come to market have been so-called ‘thematic’ ETFs, which offer exposure to a secular trend or opportunity.

Speaking at the Financial Standard’s forum on the growth of Exchange Traded Products was a panel of three experts, Ganesh Balendran from ETF Securities, Dan Annan CEO of Cosmos Asset Management and William Spraggett distribution partner at 3iQ Digital Asset Management. The three discussed the rapid growth of cryptocurrency in Australia and the trends going forward.

ETF Securities, one of Australia’s leading exchange-traded fund (ETF) issuers, says “we’re just getting started” when it comes to the robotics, automation and artificial intelligence boom. In its view, the sector is still in its infancy and this revolution will touch almost every corner of the world. Director of research at index developer and research…

In a world of new asset classes, automation and sustainable earnings, there’s no better way to diversify than through exchange-traded funds. ETFs come in different shapes and sizes, including shares or bonds, domestic or international, small-cap or large-cap, hedged or unhedged. ETFs are growing in popularity. According to Betashares, the Australian-listed ETF market hit $102.9…

Lesson #1. Gold does well in crises, acting like portfolio insurance Every investor wants an asset that offers downside protection, or insurance of a sort. And preferably one that is not suspiciously complicated or synthetic. Perhaps the major lesson from the coronavirus is that gold can provide this type of insurance, as the yellow metal…

$200 billion industry super fund, AustralianSuper, which is Australia’s largest both by members and assets, this week confirmed that the ETF Securities Gold ETF (ASX: GOLD) had been added to its member direct investment menu. The member direct investment menu offers members the ability to build their own portfolio, under the AustralianSuper banner, from a…

2020 was a watershed year for biotech companies around the world. The combination of urgent need, commitment and massive government support saw the huge benefits of research and development on show, when not one but multiple companies produced vaccines for the Coronavirus. Extensive coverage of the sector generated huge enthusiasm for it, with many stocks…

It’s a big call, but Reliance Industries (BSE:500325) may well be the most interesting company in the world. The Indian conglomerate, founded by Dhirubhai Ambani in 1997 and now controlled by his son Mukesh Ambani, became the first Indian company to exceed US$200 billion ($256.4 billion) in market capitalisation in 2020. In recent months, the…