-

Sort By

-

Newest

-

Newest

-

Oldest

The Australian stock market has seen a stagnation in returns since 2006, leaving many questioning the wisdom of long-term equity positions. For retirees, it’s a particularly fraught issue, as their financial security depends on how these investments perform.

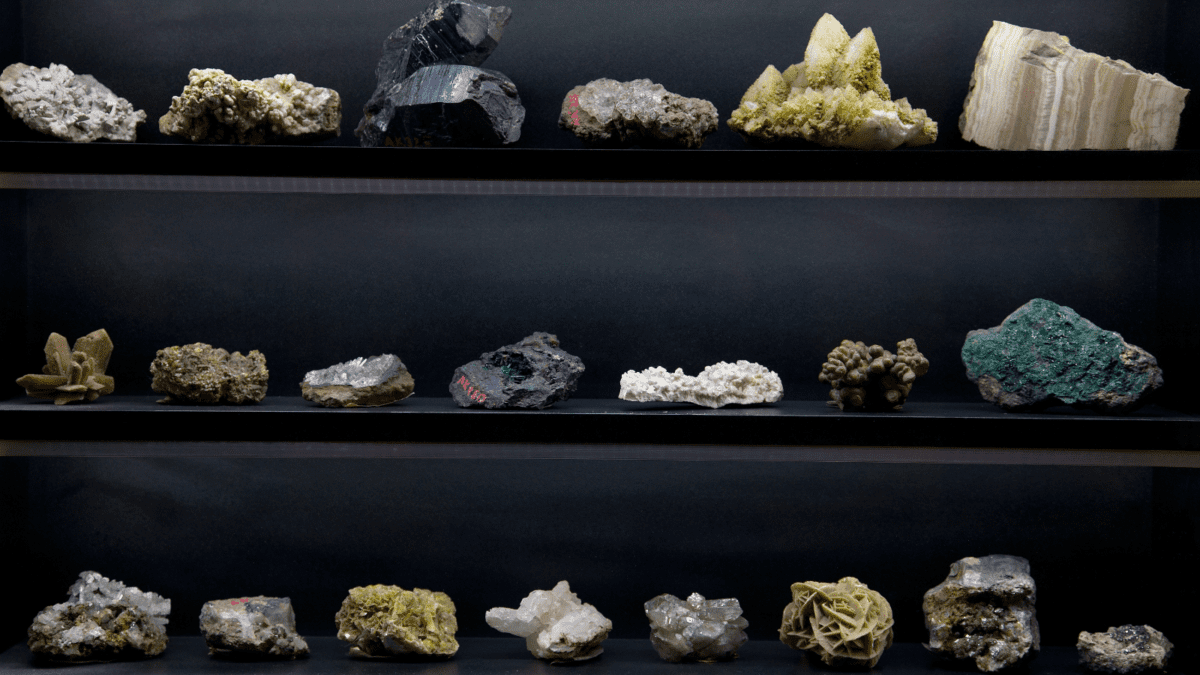

Australian companies are poised to play a key role in the clean energy transition, with major projects in critical minerals emerging to meet new demand for rare earths elements. Here are four ASX stocks likely to benefit from the new mining boom.

As an ever-more-connected world makes it harder to deliver uncorrelated portfolios, there are still strategies investors can use to add diversification. Industry leaders recently discussed opportunities in equities and fixed income at The Inside Network’s inaugural Investment Leaders Forum in Queenstown, New Zealand.

The promise of AI is inflating the prices of big tech stocks, and none have as much positive momentum as Nvidia – a big red flag, says Atrium Investment Management’s Brendan Paul. The key question is whether such companies can maintain long-term growth that justifies their elevated multiples.

It is striking how little little yield premium equities are offering over the official interest rate at them moment, says Ruffer’s Steve Russell. Investors may be tempted, but he warns that a cautious road may suit for the period ahead.

The current economic cycle is too changeable to set any portfolio to autopilot, according to Mason Stevens’ Jacqueline Fernley. Counterpoints to conviction are needed, and the devil’s advocate should be your friend.

“Gradually, and then suddenly”, the old Hemingway quote goes. The same could be said for corporate earnings, which Ruffer’s Jasmine Yeo believes are in danger of taking a sharp southerly turn.

Proactive management and stock picking are, in some ways, two sides of the same coin. But advisers and investors should be aware of their fundamental differences, according to HMC Capital.

Australia’s dividend imputation system is designed to stop the double taxation of company profits. While investing in companies that pay fully franked dividends can be tax effective, tax should never be the primary determinant of a decision to buy shares.

Rising iron ore prices helped mining heavyweights BHP Group, Rio Tinto, Fortescue Metals and Mineral Resources on Thursday, and in turn that helped to push the major indices higher. The benchmark S&P/ASX200 index finished Thursday up 3.8 points at 7,255.4, while the broader All Ordinaries gained 3.9 points to 7,460. Iron ore has risen 15 per cent since the start of 2023, on optimism…