RAIZ launches custom models, Bitcoin

Micro-investment platform Raiz Invest (ASX: RZI) capped off a stellar year by announcing the launch of its Custom Portfolio product this week. The option joins the seven existing automated investment portfolios that have seen one of Australia’s first FinTechs grow to over $600 million in assets under management.

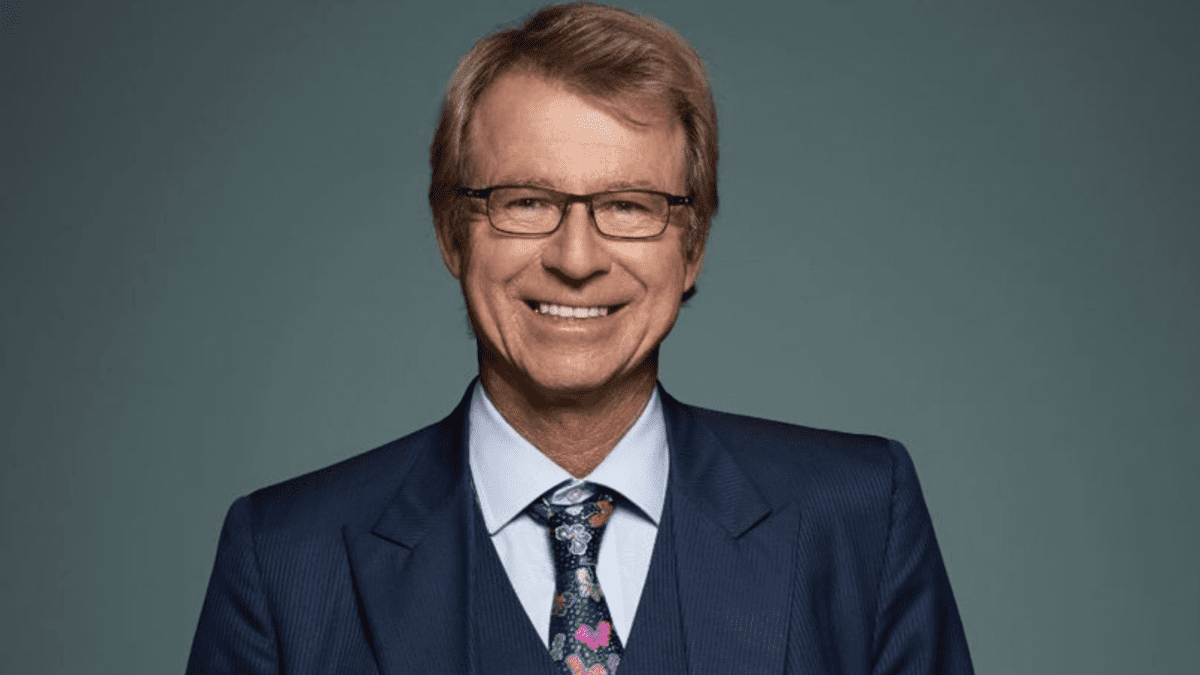

In a personal letter to shareholders and customers, CEO George Lucas highlighted the challenges the company faced and opportunities that have arisen during the pandemic. Lucas reiterated his confidence in the strong growth in active customers, which now exceed 305,000, up 19% in the final quarter of 2020 alone. After surpassing $500 million in assets under management in the September quarter, Raiz reported $605 million at the end of 2020. Management remains positive on the outlook, with the CEO suggesting a target of $1 billion in assets by the end of 2021 was a “realistic goal.”

Responding to customer demand, Raiz launched its seventh portfolio, dubbed “Sapphire,” which included an allocation to the on-fire Bitcoin cryptocurrency, with the asset itself up 140% in the last three months of the year alone. According to Raiz research this is the “world’s first retail fund with Bitcoin.”The fund quickly added 17,500 investors and $33 million in assets under management.

But it is the launch of the “Custom Portfolio” that has the fast-growing company setting its sights on the lucrative $730 billion SMSF sector. The Custom Portfolio allows investors to build their own “model portfolio” via the Raiz Invest platform, from a selection of 14 exchange traded funds, and have it automatically rebalanced whenever a dollar is received. The differentiating point, according to management, is the fact that only a platform fee is charged: all brokerage and rebalancing costs are not out-of-pocket expenses.

The RZI share price has responded positively, increasing over 400% from a March low of 31 cents, to $1.28.