Is it time to hedge the Australian dollar?

Is the Australian Dollar (AUDUSD) going to bounce back? Should investors think about hedging the Aussie dollar? Here’s a question Owen received from a Rask Invest members this week.

Hey Owen, could you please do an article on hedging? Do you think about it all, or would you ever do it, or just ignore it for the very long run thinking an average around 70c for AUD/USD?

For those who don’t know, currency hedging is a process undertaken by investment firms to ‘lock-in’ the currency rate. For example, imagine you plan to go on a holiday to the USA next year and you’re worried about the USD currency falling from 0.65 to 0.5 (meaning you would get less USD when you go). An investment bank could say to you, “give us the money now and we’ll make sure the value of your currency stays at 0.65.” Keep in mind they only neutralise the currency effect – if the price of NYC hotdogs goes up, you’ll still have to pay the higher price.

Small investors – like Rask – can do currency hedging too, using less sophisticated tools like the US dollar ETFs, Australian dollar ETFs (the opposite), converting AUD to USD in our brokerage accounts, or even buying, for example, shares of ASX-listed companies that earn a majority of their revenue in US dollars (e.g. Cochlear, ResMed, CSL, etc.). Each of these strategies has its weaknesses and strengths.

Back to the topic at hand…

Hedging and exchange rates is an interesting topic, with some people paid multiples more than myself to pass judgement. However, having spent some time inside the funds management rating team at Zenith Investment Partners (arguably Australia’s best ratings agency for fund managers), what Owen gleaned is that hedging can have benefits in a portfolio that is actively managed. However, the effects can be muted over a long period of time.

Many fund managers offer the choice of two strategies:

- Rask Invest Global Fund

- Rask Invest Global Fund (hedged)

(Note: as you will likely know, most big global fund managers often offer a hedged version and an unhedged version. The hedged version would cost a bit more.).

Provided we’re investing for 10+ years and the currency isn’t at some extreme (e.g. $1.10 a few years back, or below $0.50) the effects of volatile currencies shouldn’t be much of an issue for Australian investors (in my opinion).

If you’re nearing retirement it would make sense to consider hedged exposure. And if you’re investing in international bonds, the potential yields/returns on offer are almost certain to be quite low (sub-5%), so currency hedging is often what’s best for most investors.

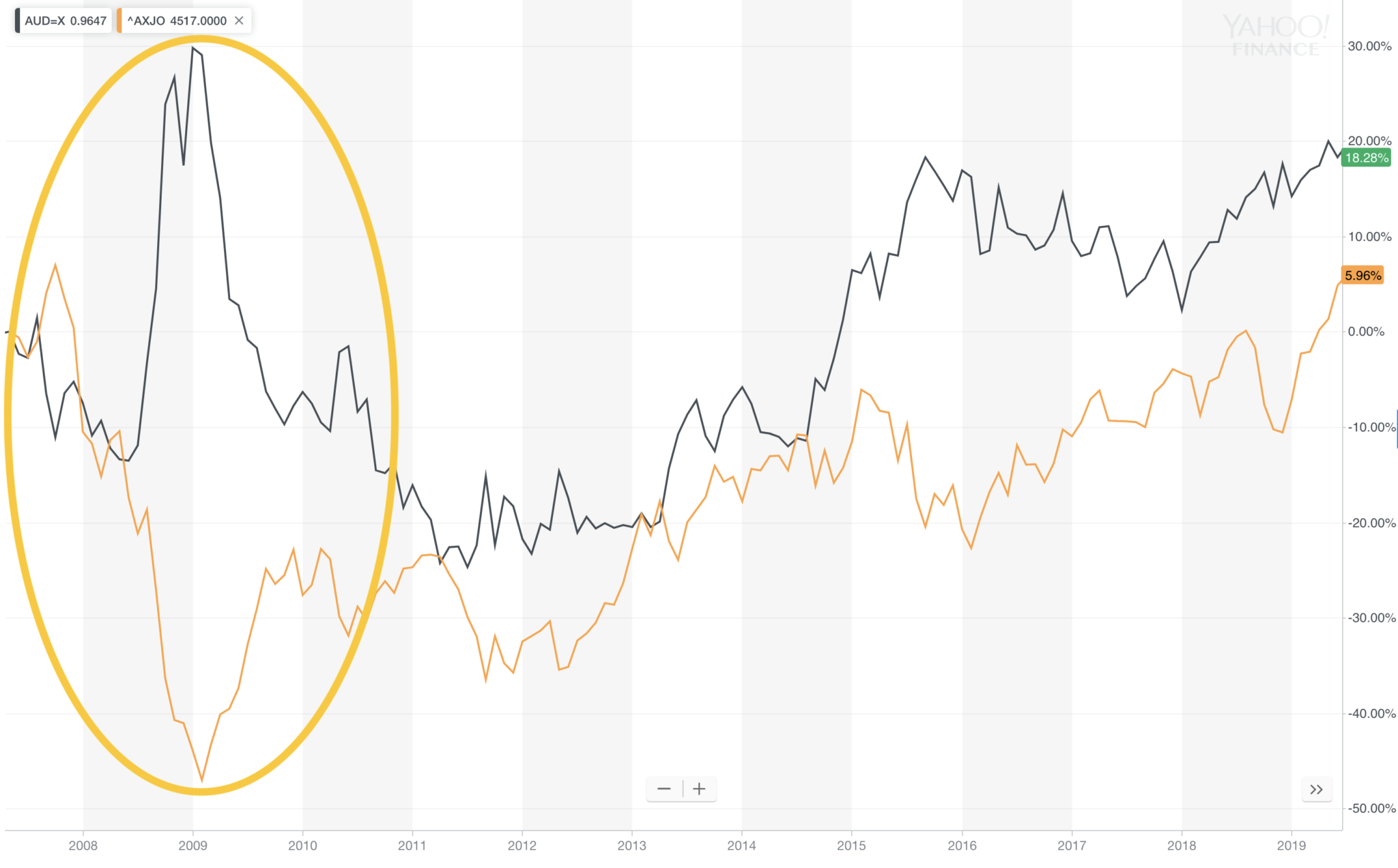

In the past 10 years, fund managers, companies and investors like Owen have benefitted immensely from the positive ‘carry’ (or effects) of having USD exposure. For example, Rask measures Rask Invest’s returns in AUD for simplicity. Our returns look pretty stellar right now, in part due to currency movements (a weaker Aussie boosts our USD holdings on the NYSE and NASDAQ). This is not by accident.

With the long-run AUD average between 75 and 80 cents according to OFX, it’s hard to imagine Rask is going to get the same positive benefit/carry in our returns going forward. That said, currency markets are amongst the hardest to predict, so Owen could be wrong. It wouldn’t be the first time.

One final note, investing in US dollar-backed positions can have a very positive impact on Australian investors’ performance. Why? In times of uncertainty (as we’ve seen now), the USD can appreciate (AUD falls) which provides a cushion for local investors in a crash. Owen wrote about this in our write-up on USD.

In summary, hedging and currency are one of those things that should not be overthought. In Rask’s valuations, it’s easy to insert a currency closer to average (e.g. 70 cents) and stress-test a position. But over the long run, it shouldn’t make a massive difference to our style of investing.

For example, if Owen finds one potential investment idea that could go on to 4x (and the currency swings widely) versus another position that might rise 1x, 2x or 3x – he’d be crazy not to focus on the business first and foremost and cop the volatility.