Dividends ahoy!

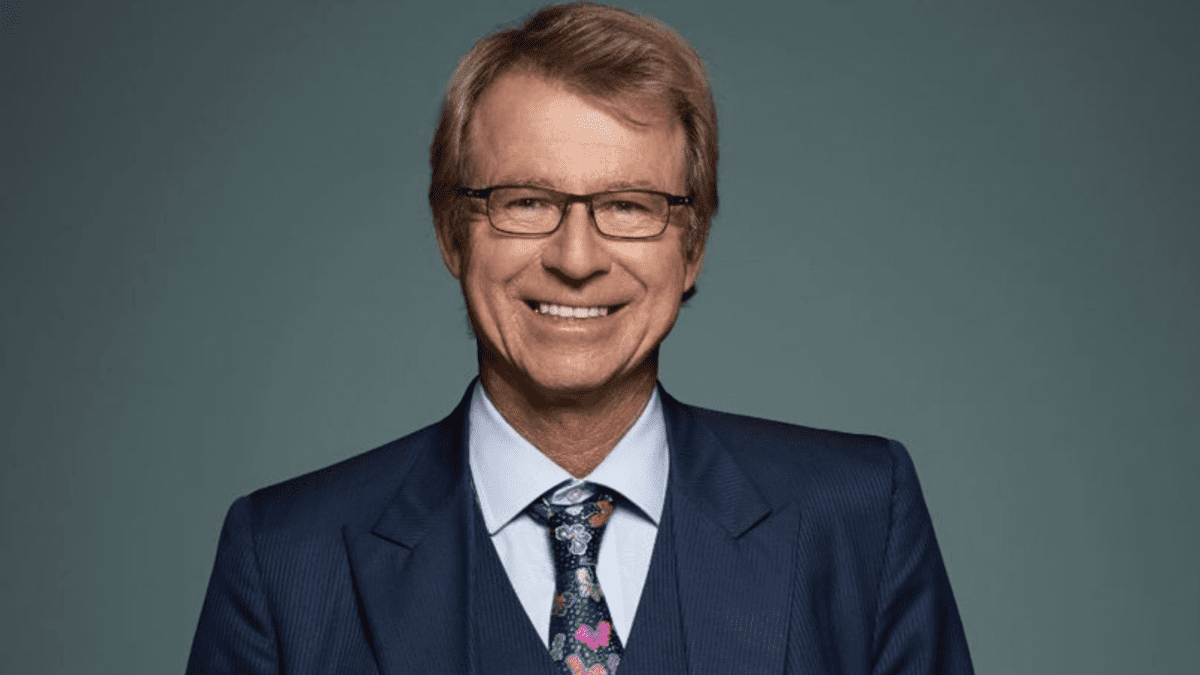

Are investors looking at a dividend bonanza in 2021? According to Dr Don Hamson, Portfolio Manager of the Plato Australian Shares Income strategy, the drought may be coming to an end. According to one of the leading active income investors in the country, investors in the ASX 200 are looking at an improved dividend backdrop post reporting season. In fact, they now forecast a gross yield of 4.8% for the year ahead, a significant improvement on their expectations at the beginning of February.

Looking back investors must be somewhat shocked, but also relieved, with dividends set to rebound quickly after the most powerful economic shock in several decades. And according to Hamson, this couldn’t come soon enough. “At every cash rate cut over the past decade, self-funded retirees have been dealt a blow” he says, with the cash rate now ultimately locked at 0.1% until 2024, they are once again being forced to seek income elsewhere.

Whilst the backdrop is positive, delivering the forecast yield is not likely to be simple, with the group warning against adopting a ‘set-and-forget’ approach to dividends. They suggest an additional 2 to 3% in income can be delivered through active management whilst also keeping an eye on increasing franking credit balances at a number of companies.

So where are the dividends coming from?

According to their analysis, some 59 per cent of the improvement in the forecast yield is coming from the financial sector. Hamson flags the Commonwealth Bank (ASX: CBA) as a ‘compelling opportunity for investors today’ after declaring a $1.50 dividend, just 25 per cent lower than in February 2020 but representing a payout ratio of just 67 per cent of earnings. Management of CBA have already indicated that the dividend payout will be closer to 70-80 per cent in 2021.

Following the theme of a banking recovery, Bendigo and Adelaide (ASX: BEN) was flagged as another contributor, with their earnings almost 30 per cent above expectations after growing 2% on the prior corresponding period.

But it is in the mining sector where the true standouts lie, a sector where Plato have been in their own words ‘banging the drum’. They highlight that three of the top six dividend payers in Australia today are mining stocks, specifically Fortescue Metals (ASX: FMG), Rio Tinto (ASX: RIO) and BHP (ASX: BHP), which according to CommSec are yielding 11.7 per cent, 7.6% and 5.5% respectively.

As is typically the case when the iron ore price rallies, investors grow concerned about the sustainability of dividends and recent trends. However, Plato remain confident highlighting that even with significant falls in the iron ore price, all three companies would remain highly profitable.

Finally, the surprise packet of 2020 and the pandemic in general has been the incredible resilience of pockets of the retail sector. Consumer discretionary stocks, but particularly those that have benefitted from the home renovations or work from home trend, has benefitted from an e-commerce boom. JB HiFi (ASX: JBH) was a core holding of the fund, announcing a record $1.80 dividend in February representing a gross yield of 5.1%.

With the dividend supported by an 86 per cent increase in profit, and January 2021 sales still tracking at a growth rate of 17 per cent, this is one they clearly have confidence in.