-

Sort By

-

Newest

-

Newest

-

Oldest

The ASX 200 fell 3.8 per cent over the month, the biggest fall this year, as investors sought to understand the impact of war, economic factors and other concerns on markets at home and abroad, according to Selfwealth.

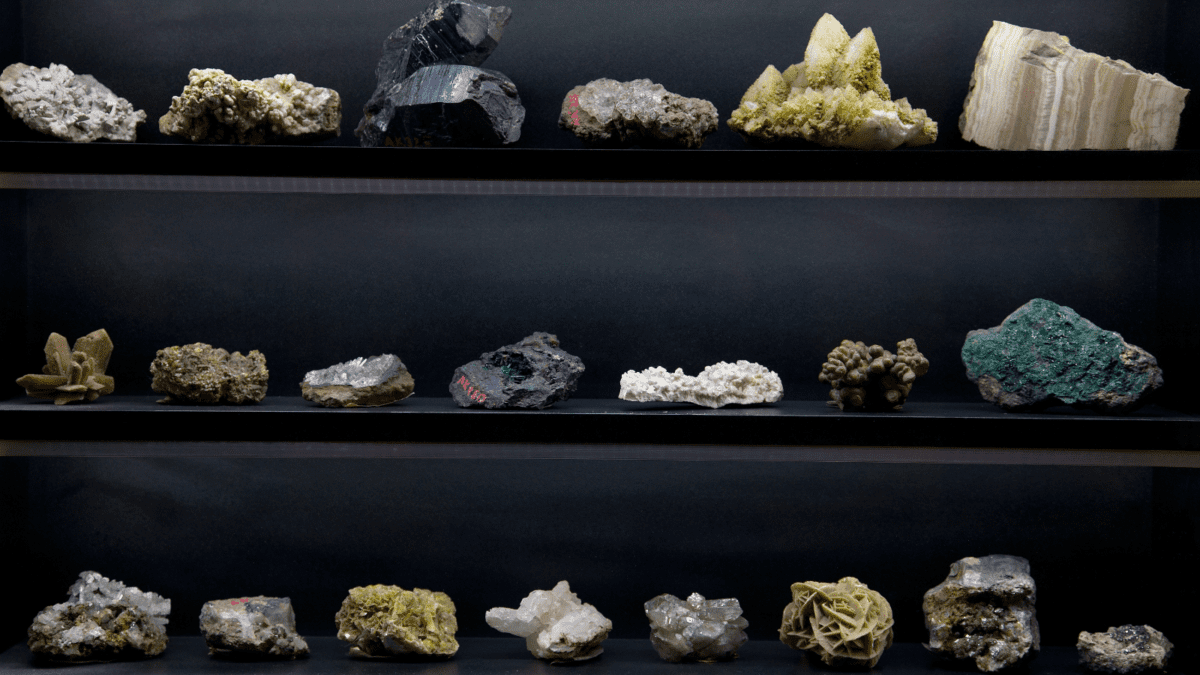

Australian companies are poised to play a key role in the clean energy transition, with major projects in critical minerals emerging to meet new demand for rare earths elements. Here are four ASX stocks likely to benefit from the new mining boom.

Australian companies’ dividend payouts are down 24 per cent from a year ago, as higher interest rates and cash flow challenges darken the outlook. Payouts from miners decreased significantly, although the dividend picture remains positive for banks.

In addition to falling for the ‘big market delusion’ that competitors won’t emerge and current performance expectations are rational, investors are also overplaying Nvidia as a ‘safe’ hand in the AI game, according to a new research paper.

One of the most surprising outcomes from the better-than-expected August reporting season was the strong performance of consumer discretionary retailers, as Australians continued to weather higher interest rates and inflation better than many analysts had feared.

Despite continuing strong economic data for Australia, markets have forecast significant earnings downgrades, and results have been mixed so far. But a main highlight – CBA’s record $10 billion profit – may not be enough to improve investors’ outlook on the banking sector, analysts say.

Focussing on a concentrated portfolio of quality and growing stocks can expose investors to strong profit growth and some of the best companies in the world, Claremont Global’s Bob Desmond said at the Inside Network’s recent Investment Leaders Forum. It just requires thinking through the noise and understanding a company’s culture.

With deteriorating economic conditions dampening the banking outlook, some trading momentum may be leaving the sector after a strong two-month run. Six in 10 trades of big-four banks on the Selfwealth platform in July were sell orders, and headwinds are only picking up from here.

Analysis of June trading by Selfwealth platform users with portfolios of more than $1 million showed clear patterns in how different generations prefer to invest, with Baby Boomers seeking income and quality while Millennials and Gen X-ers prefer exposure to the clean-energy transition and ETFs.

The promise of AI is inflating the prices of big tech stocks, and none have as much positive momentum as Nvidia – a big red flag, says Atrium Investment Management’s Brendan Paul. The key question is whether such companies can maintain long-term growth that justifies their elevated multiples.

Corporate profit growth is expected to moderate, especially in sectors focussed on consumer sales, and mining companies have seen large downgrades. Meanwhile, markets are still not fully pricing in the high risk of recession, some analysts say.

After a three-month run as the most-traded ASX stock on Selfwealth’s platform, Neuron Pharmaceuticals ceded its spot to CBA in June as healthcare, mining and banking stocks jostled for investors’ attention.